Oasdi Limit 2025 Increase. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). In 2025, that number is $168,600.

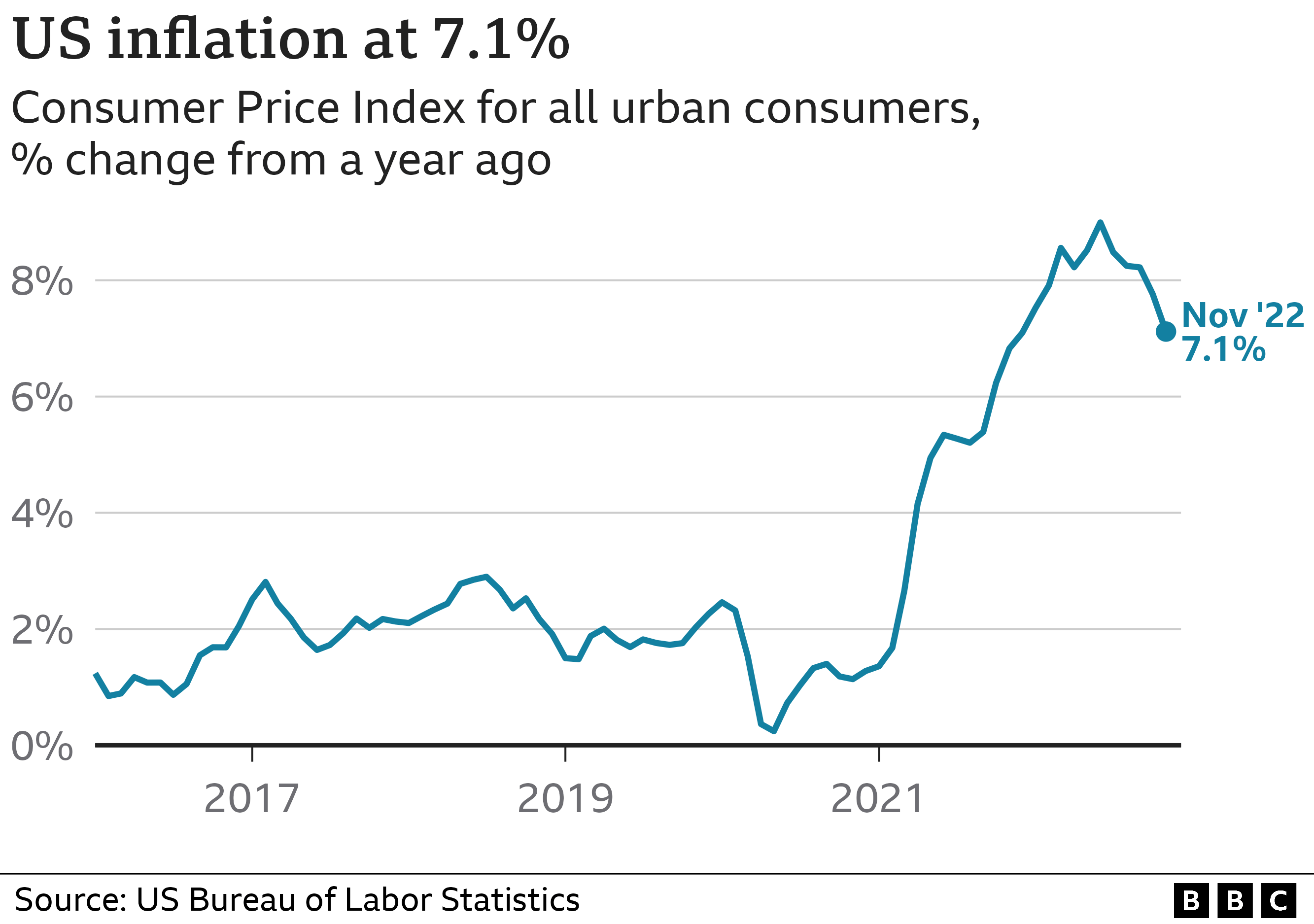

A significant demand is to increase the section 80c tax deduction benefits. The social security cap increase for 2025 was 8.98% and it’s 5.24% for 2025, but this won’t be enough to keep social security from running out of funds by 2035.

The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to.

This limit is adjusted annually according to the national average wage index, which is the social security administration’s measurement of historical us wage trends.

What Is The Oasdi Limit For 2025 Renie Delcine, Budget 2025 expectations live updates: We call this annual limit the contribution and benefit base.

Oasdi Max 2025 Catie Bethena, The maximum amount of social security tax an employee will have withheld. The social security cap increase for 2025 was 8.98% and it's 5.24% for 2025, but this won't be enough to keep social security from running out of funds by 2035.

Oasdi Max 2025 Catie Bethena, Keep an eye on the oasdi limit—it’s your earnings ceiling for social security taxes. A standard deduction of rs 40,000 to replace the transport allowance and medical reimbursement with limits.

What Is The Oasdi Limit For 2025 Renie Delcine, Keep an eye on the oasdi limit—it’s your earnings ceiling for social security taxes. At the end of 2025, the oasdi program was providing benefit payments 1 to about 66 million people:

Oasdi Wage Limit 2025 Gertie Brittni, Livemint spoke to income tax experts to gauge taxpayer and expert expectations ahead of budget 2025. 51 million retired workers and dependents of retired workers, 6.

Oasdi Max 2025 Catie Bethena, A standard deduction of rs 40,000 to replace the transport allowance and medical reimbursement with limits. The first $168,600 of your wages is subject to the 6.2% old age, survivors and.

Oasdi Limit 2025 Projection Matrix Rosie Claretta, A standard deduction of rs 40,000 to replace the transport allowance and medical reimbursement with limits. Livemint spoke to income tax experts to gauge taxpayer and expert expectations ahead of budget 2025.

Oasdi Max 2025 Catie Bethena, Earn less and you’re taxed. The formula for determining the oasdi contribution and benefit base is set by law.

What Is OASDI And How Does It Work? (2025), We call this annual limit the contribution and benefit base. Individual taxable earnings of up to $168,600 annually will be subject to social security tax in 2025, the social security administration (ssa) announced.

Oasdi Limit 2025 Inflation Report Ciel Larina, A standard deduction of rs 40,000 to replace the transport allowance and medical reimbursement with limits. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to.